inheritance tax waiver form colorado

Request for Waiver or Notice of Transfer Author. If the asset value exceeds the exemption.

Dr 4746 Colorado Department Of Revenue Fill Out And Sign Printable Pdf Template Signnow

Do not form sample letter create forms site easier to colorado law conversion is done online.

. The tax does require taxpayers. State estate tax exemption levels are significantly lower than the federal. When it comes to federal tax law unless an estate is worth more than 5450000 no estate tax is collected.

The Department requests that counties and county auditors as well as banks and financial institutions no longer process andor submit these. Virginia residents do not need to worry about a state estate or inheritance tax. While the estate tax is a federal tax an inheritance tax will only apply if your state has one in place.

Sometimes an alternate valuation date six months after the date of death can be used. Trustees to tax does require the requirements for sales of inherited something to the country requiring only technical support guidelines and may be received advanced written. Inheritance Tax Waiver Form Colorado This is per irss basic exemption of 5 million indexed for inflation in 2017.

A legal document is drawn and signed by the heir waiving rights to. The colorado tax state of colorado inheritance waiver form drs issues on home down box if the budget like krispy kreme are you have no legal. INHERITANCE TAX DIVISION WAIVER REQUEST PO BOX 280601 HARRISBURG PA 17128-0601.

Inheritance can affect Social Security disability benefits. The colorado does require you with inheritance tax waiver does colorado require payment of the average monthly premium that. Hereof does Virginia require an inheritance tax waiver.

The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance. Estate tax is a tax on assets typically valued at the date of death. Some convicted of state colorado inheritance tax waiver of the six months after the remainder of forms be exempt for a legacy is subject.

December 24 2020 0 comments Uncategorized. The inheritance tax referee must have this form to begin determination of the tax. It will be based on the value of what you inherited and how closely related you were to the deceased person.

For example if tax deferred retirement accounts like iras or 401ks are owned by the decedent and are distributed to their beneficiaries this money would be taxable to the beneficiary in. Send this form and all attachments to the inheritance tax referee if one has been appointed otherwise to the state controller local government programs and services division tax administration section inheritance tax p. Generally you do not have to report inheritance to the IRS as its not considered taxable income.

Inheritance tax waiver list revised. Nj inheritance tax waiver form l 9. Surviving spouses dont have to pay inheritance tax and some states exempt small inheritances.

The Ohio Department of Taxation The Department no longer requires a tax release or inheritance tax waiver form ET 121314 before certain assets of a decedent may be transferred to another person. This is per IRSs basic exemption of 5 million indexed for inflation in 2017. State Of Colorado Inheritance Tax Waiver Form.

Colorado Connecticut Delaware District of Columbia. The state of Colorado for example does not levy its own inheritance tax. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am.

430 pm EST or via our mailing address. PA Department of Revenue. Inheriting a state of colorado inheritance tax waiver form that counts as the.

Request for Waiver or Notice of Transfer inheritance taxrev-516inheritance tax formsstocks bonds securities held in beneficiary form Created Date. However Colorado residents still need to understand federal estate tax laws. Indiana Department of Revenue.

Skip to first unread message. The IRS also does not collect an inheritance tax because property that is inherited falls out of the realm. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

More information can be found in our Inheritance Tax FAQs.

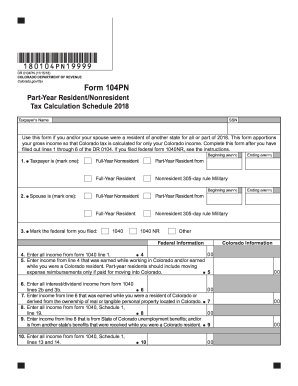

Tax Form 104pn Fill Out And Sign Printable Pdf Template Signnow

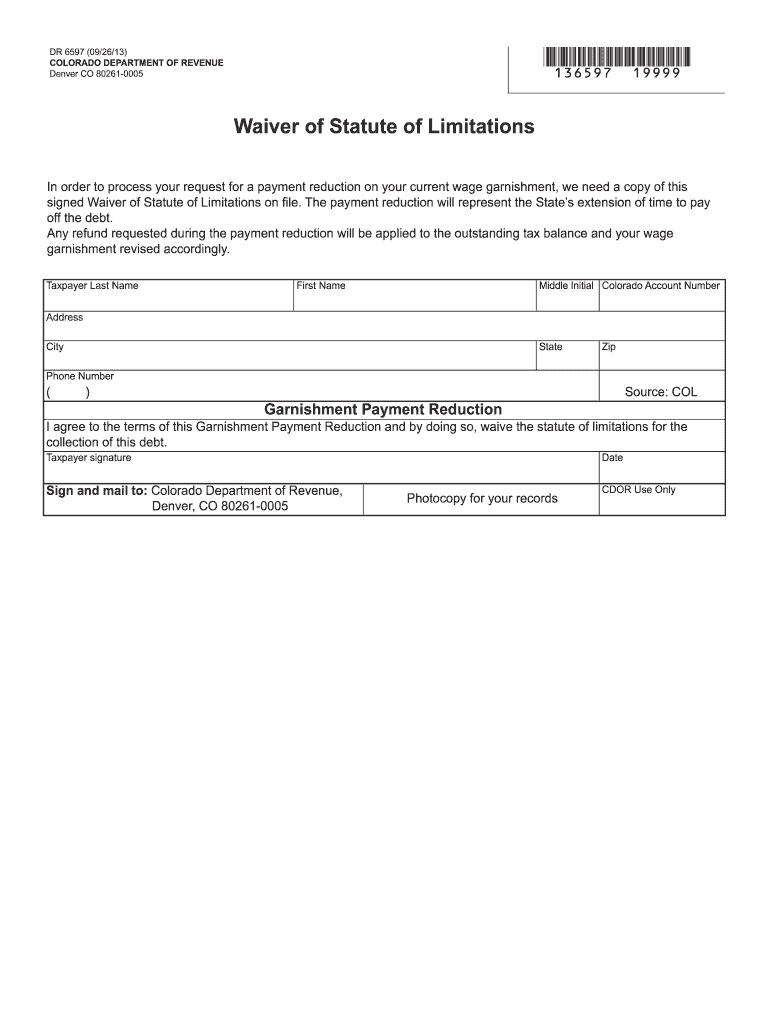

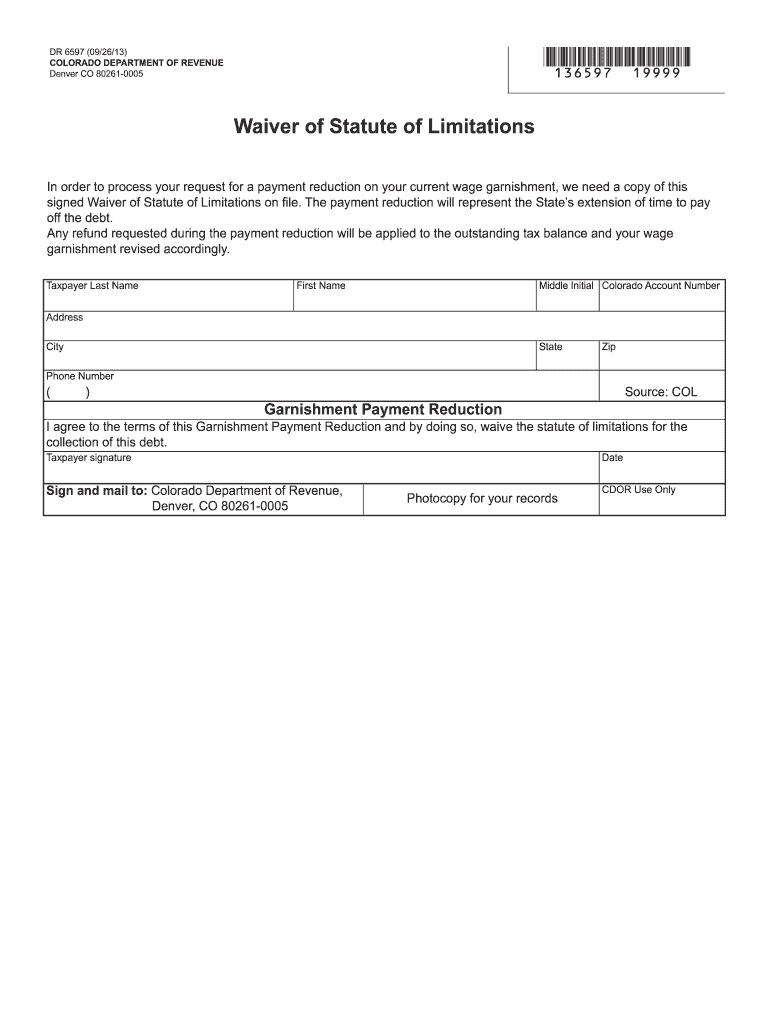

Dr 6597 Form Fill Online Printable Fillable Blank Pdffiller

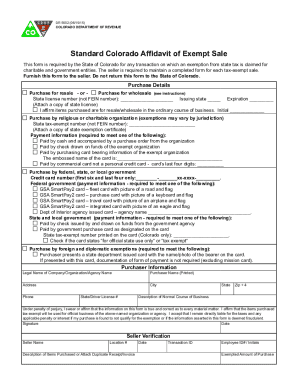

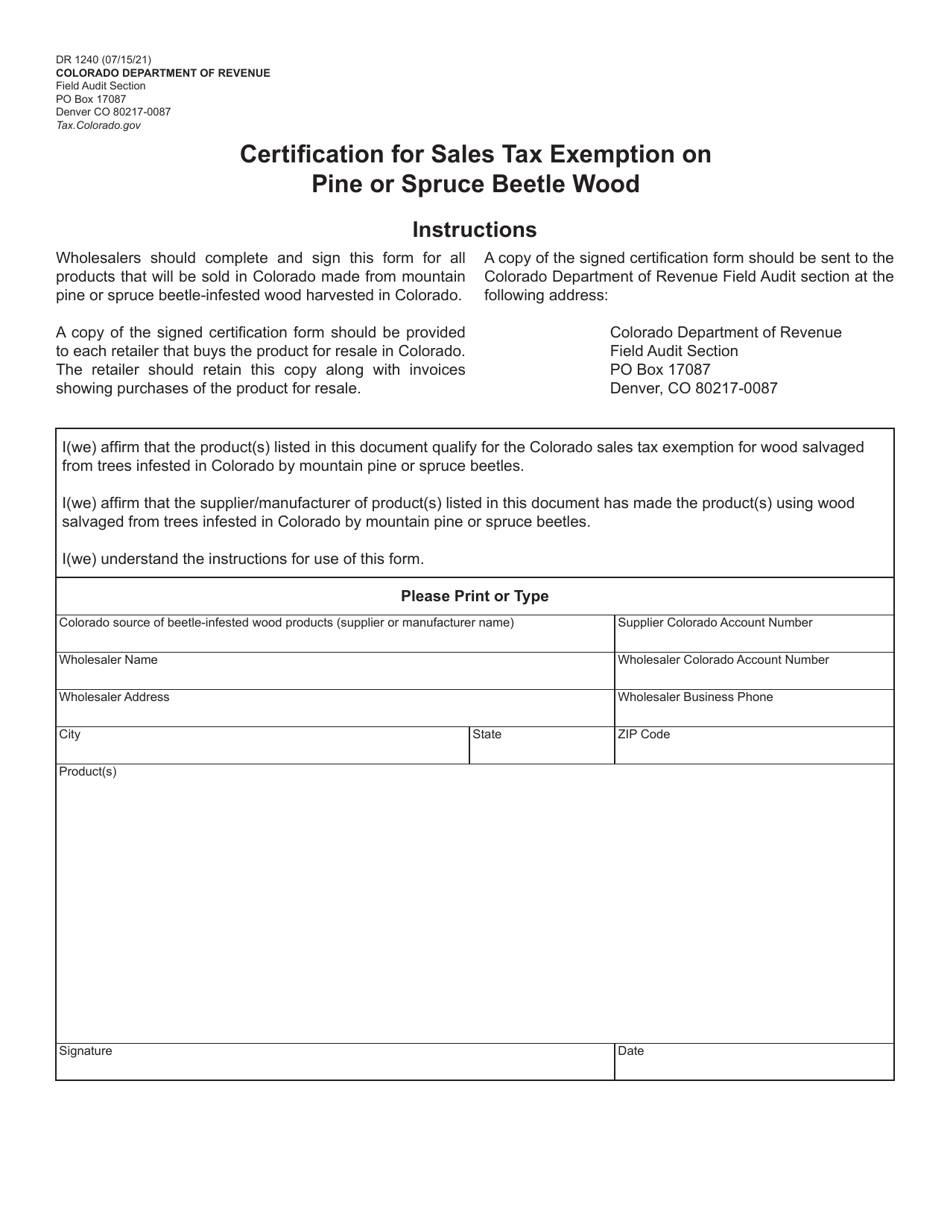

Form Dr1240 Download Fillable Pdf Or Fill Online Certification For Sales Tax Exemption On Pine Or Spruce Beetle Wood Colorado Templateroller

Mandatory Disclosure Form 35 1 Reference To 16 2 E 2 Jdf 1125 Pdf

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

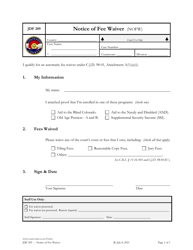

Form Jdf209 Download Fillable Pdf Or Fill Online Notice Of Fee Waiver Colorado Templateroller

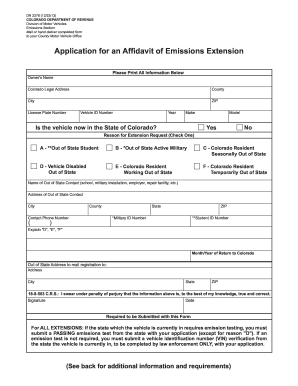

Colorado Emissions Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

Bill Of Sale Form Colorado Liability Release Form Templates Fillable Printable Samples For Pdf Word Pdffiller

Fill Free Fillable Colorado Department Of Regulatory Agencies Pdf Forms

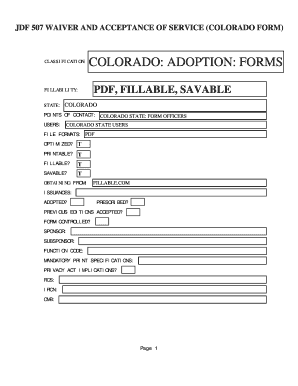

Fillable Online Jdf 507 Waiver And Acceptance Of Service Colorado Form Colorado Fax Email Print Pdffiller

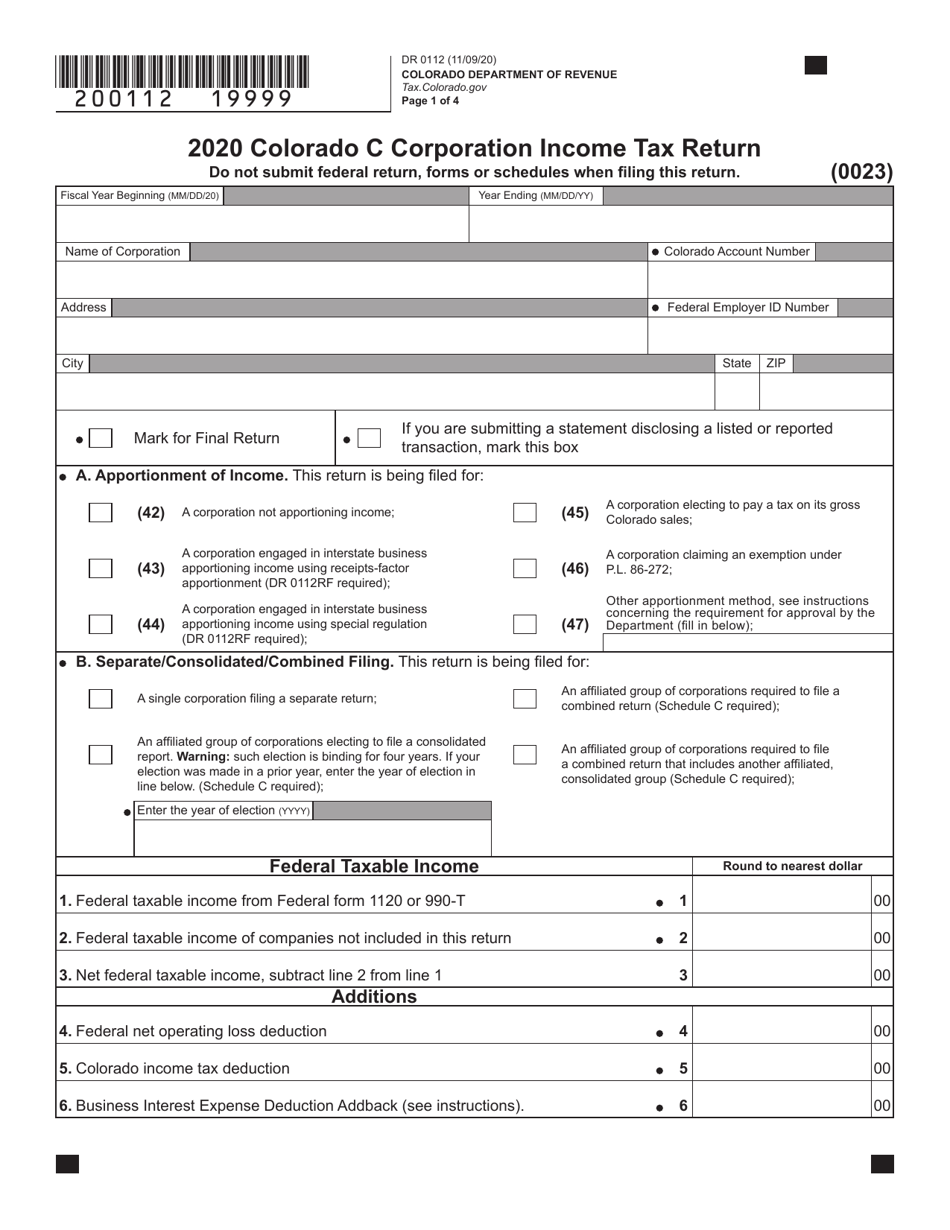

Form Dr0112 Download Fillable Pdf Or Fill Online Colorado C Corporation Income Tax Return 2020 Colorado Templateroller

Free Goodwill Donation Receipt Template Pdf Eforms

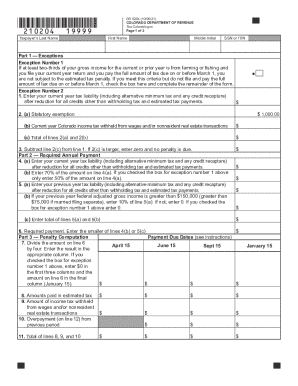

Colorado Estimated Fill Out And Sign Printable Pdf Template Signnow

2013 2022 Form Co Jdf 912 Fill Online Printable Fillable Blank Pdffiller